Solution:

It is given in the problem that the total cost of the sailboat is $ 20,000 and 10% of the total cost is paid at the time of buying it.

Therefore we can say that only 90% of the total cost will be amortized. And it will have to be paid over a period of 14 years. This 90% of the total cost will be the Present Value (PV).

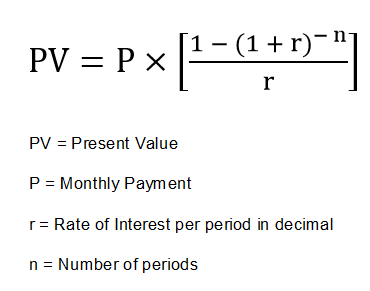

In this problem, we are asked to find out the monthly payment (P) and total interest (I). To find these two values, first we will have to find the values of Present Value, Rate of Interest per period in decimal, and Number of periods. So let’s find these values first.

Present Value (PV)

= 90% of Total Cost

= {90/100} × 20,000

= $ 18,000

Rate of interest per period in decimal (r)

= 12% / 12

= 1%

= 0.01

Number of periods (n)

= Number of years × 12

= 14 × 12

= 168 Now, we know that

Here, PV = Present Value

P = Monthly Payment

r = Rate of Interest per period in decimal

n = Number of periods

Now, put these values of PV, r, and n in the above formula to get the value of P.

18,000 = P × [ {1 – (1 + 0.01) – 168} ÷ 0.01 ]

18,000 = P × [ { 1 – (1.01) – 168} ÷ 0.01 ]

18,000 = P × [ { 1 – 0.1879 } ÷ 0.01 ]

18,000 = P × [ 0.8121 ÷ 0.01 ]

18,000 = P × 81.21

18,000 ÷ 81.21 = P

P = $ 221.65

So, the required value of monthly payment is $ 221.65

Now, we will calculate the value of total interest paid over the period of 14 years.

Total Interest

= Number of Periods × Monthly Payment – Present Value

= 168 × 221.65 – 18,000

= 37,237.2 – 18,000

= $ 19,237.2 Thus, the total interest paid over the period of 14 years is $ 19,237.2.